| ZIP Code | ZIP Code City/Town | ZIP Type | Average Adjusted Income(2021) |

|---|

| Slippery Rock | Standard | $344,740 |

| Clarks Mills | Standard | $138,700 |

| Farrell | Standard | $137,190 |

| Fredonia | Standard | $169,140 |

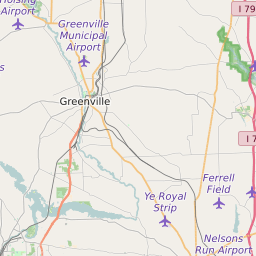

| Greenville | Standard | $416,520 |

| Grove City | Standard | $439,810 |

| Hadley | Standard | $165,750 |

| Jackson Center | Standard | $157,860 |

| Jamestown | Standard | $373,480 |

| Mercer | Standard | $427,560 |

| New Wilmington | Standard | $476,860 |

| Pulaski | Standard | $365,600 |

| Sandy Lake | Standard | $317,300 |

| Sharon | Standard | $657,360 |

| Hermitage | Standard | $511,650 |

| Sharpsville | Standard | $417,320 |

| Stoneboro | Standard | $374,700 |

| Transfer | Standard | $340,500 |

| Volant | Standard | $392,040 |

| West Middlesex | Standard | $515,900 |

| Carlton | Standard | $136,480 |

| Cochranton | Standard | $509,340 |

| Utica | Standard | $128,970 |

Source: US Internal Revenue Service